A guide to the CPA Exam sections

If you're ready to earn your CPA license, we're walking you through everything you need to know about the CPA Exam sections, from the topics covered on each exam to the test duration.

Changes to the CPA Exam sections

CPA Evolution goes into effect in January 2024 and introduces a new CPA Exam structure. In 2024 the American Institute of Certified Public Accountants (AICPA) and the National Association of State Boards of Accountancy (NASBA) launched CPA Evolution - a new CPA Exam format designed to reduce skill gaps, create flexibility, and provide greater opportunities for accountants to develop specialized knowledge in key areas.

The CPA Exam now includes three Core Exams that focus on knowledge and skills universal to all CPAs that every candidate must take and pass:

Auditing and Attestation (AUD)

Candidates are also required to take and pass one of three Discipline Exams. These Disciplines focus on knowledge and skills required within a specialization.

Business Analysis and Reporting (BAR)

An overview of the CPA Exam format

Before we dive into the individual sections, let's look at an overview of the CPA Exam format. First, the CPA Exam duration is four hours long for each section, which consists of both multiple-choice questions and task-based simulations. These exam questions are designed to assess four types of skill levels:

- Remembering and understanding

- Application

- Analysis

- Evaluation (AUD only)

Within the section, the exam format is divided into five specific "testlets," or groups of questions. Two testlets consist of multiple-choice questions and three are task-based simulations.

How is the exam scored?

Each section is scored on a scale from 0 to 99, and students must receive a 75 to pass. On all sections but ISC, multiple-choice questions and task-based simulations are both weighted 50 percent of your score. On ISC, multiple-choice questions are weighted 60 percent and task-based simulations are 40 percent.

How long do I have to complete all four CPA Exam sections?

You have a minimum of 18 months, starting from the date you pass your first section, to pass three Core sections and one Discipline. This is a rolling window of time, so if you’ve passed more than one section, only the section outside of your designated timeline will expire.

For example, if your state has an 18-month timeline, and you pass FAR in January of 2024 and REG in August of 2024, only FAR would expire in July of 2025, but your passing score in REG would be valid until February of 2026.

The National Association of State Boards of Accountancy (NASBA) recommends states adopt a 30-month timeline. While many states have or are in the process of doing so, we recommend checking with your state board to ensure you know exactly how long you have to complete your CPA Exam sections.

The AUD Core section remains largely unchanged, aside from the addition of selected BEC content. No existing AUD content moves to other 2024 CPA Exam sections. BEC topics that are moved to AUD include:

- Basic economic concepts: supply and demand, business cycles

- Business process and internal controls

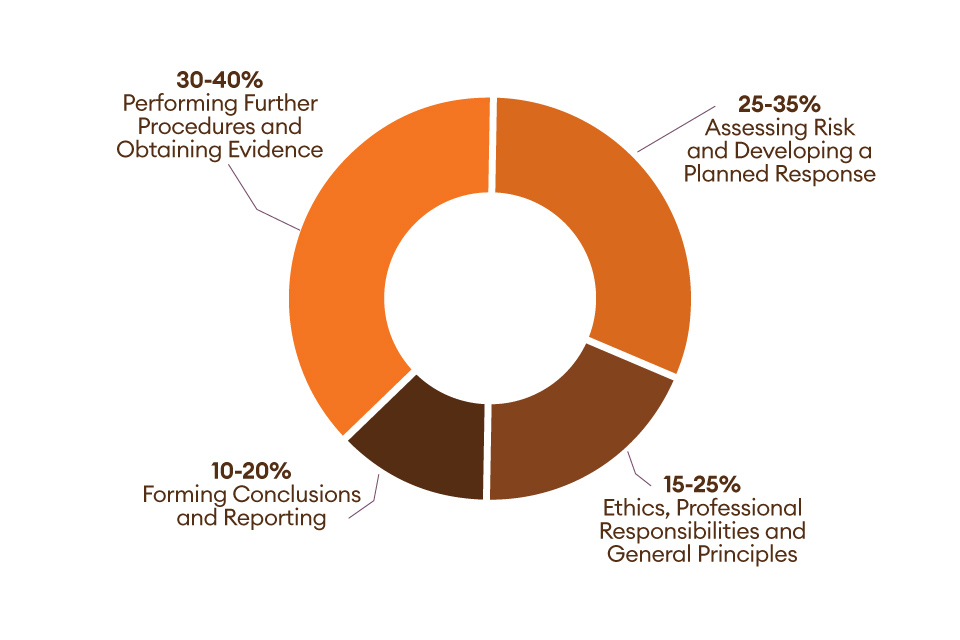

There are no changes to the content areas or the allocation of content tested in each content area. To the left is a table summarizing the AUD content areas and allocation.

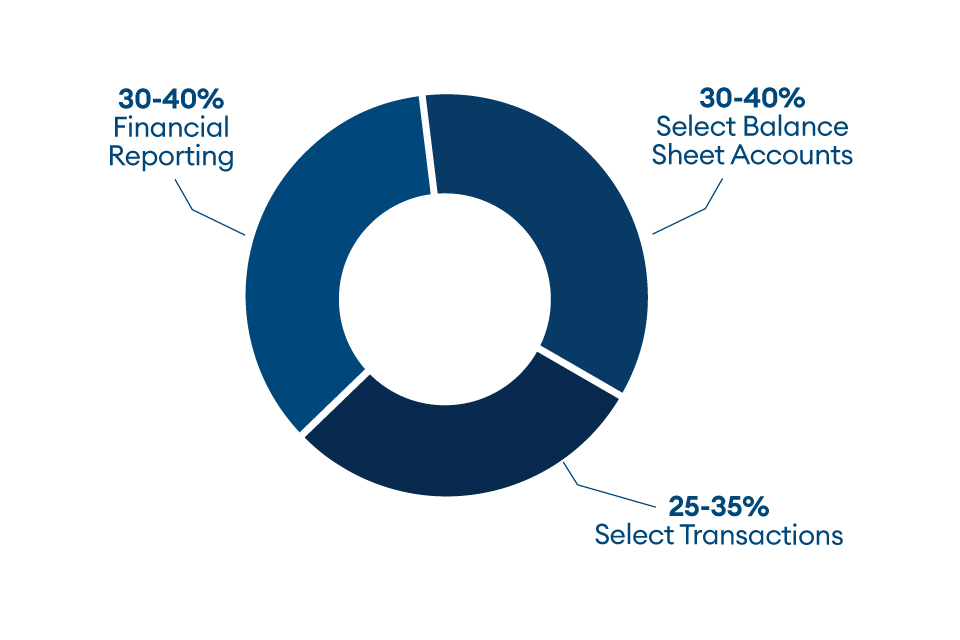

The FAR Core section tests the knowledge and skills that all CPAs must demonstrate with respect to financial accounting and reporting frameworks used by for-profit (public and non-public) and not-for-profit entities. Under the Core and Discipline model, some existing FAR content will be allocated between the FAR Core Exam section and the BAR Discipline Exam. The current FAR topics that move to BAR include:

- Indefinite lived intangible assets, including goodwill

- Internally developed software

- Analysis skill level representative tasks for revenue recognition

- Stock compensation (share-based payments)

- R&D costs

- Business combinations

- Consolidated financial statements

- Derivatives and hedge accounting

- Leases – sale-leaseback accounting and lessor accounting

- Public company reporting

- Reporting requirements of S-X and S-K

- XBRL

- Disclosures for reportable segments

- Financial statements of employee benefit plans

- Government accounting

- Format and content of the financial section of the annual comprehensive financial report

- Deriving government-wide financial statements and reconciliation statements

- Typical items and specific types of transactions and events

There are also some BEC topics that move to FAR, which include:

- Understanding and applying financial statement ratios and performance metrics

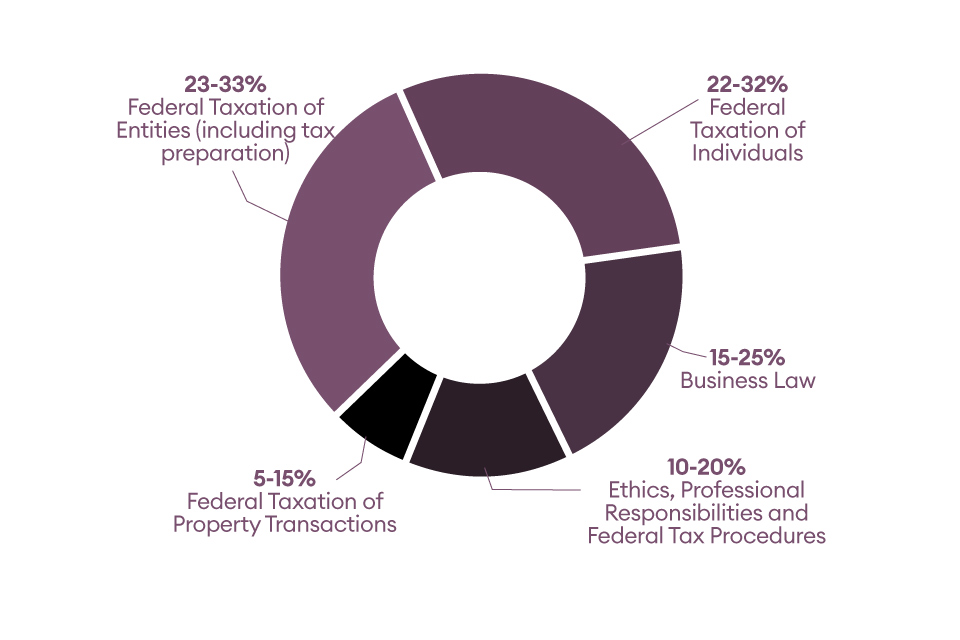

REG Core section tests the knowledge and skills that all CPAs must demonstrate with respect to U.S. ethics and professional responsibilities related to tax practice, U.S. business law and U.S. federal tax compliance for individuals and entities with a focus on recurring and routine transactions. Under the CPA Evolution Core and Discipline model, existing REG content will be allocated between the REG Core Exam section and the TCP Discipline Exam section. The REG Core Exam section will focus on routine and recurring tasks. The current REG topics that will be moved to TCP include:

Gross income concepts, such as:

- Exercise of incentive stock options (ISO)

- Imputed interest on a below-market-rate loan

- Compensation earned while employed outside the U.S.

No current BEC content has been moved to REG.

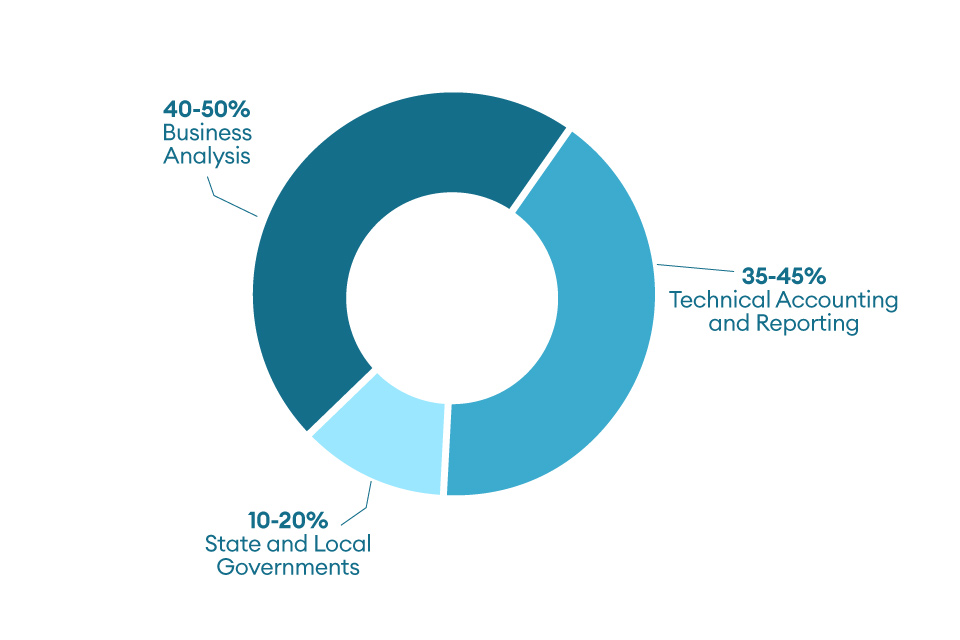

The BAR Discipline section tests the knowledge and skills a CPA must demonstrate with respect to:

- Analyzing financial statements and financial information with a focus on a CPA’s role in comparing historical results to budgets and forecasts; deriving the impact of transactions, events (actual and proposed) and market conditions on performance measures; and comparing investment alternatives

- Select technical accounting and reporting requirements under the FASB and SEC that are applicable to for-profit business entities (e.g., stock compensation, business combinations, derivatives) and higher order skills related to revenue recognition and lease accounting. These topics are moving from the current FAR Core section to this BAR Discipline section.

Financial accounting and reporting requirements under GASB that are applicable to state and local government entities. These topics are also moving from the current FAR section to BAR.

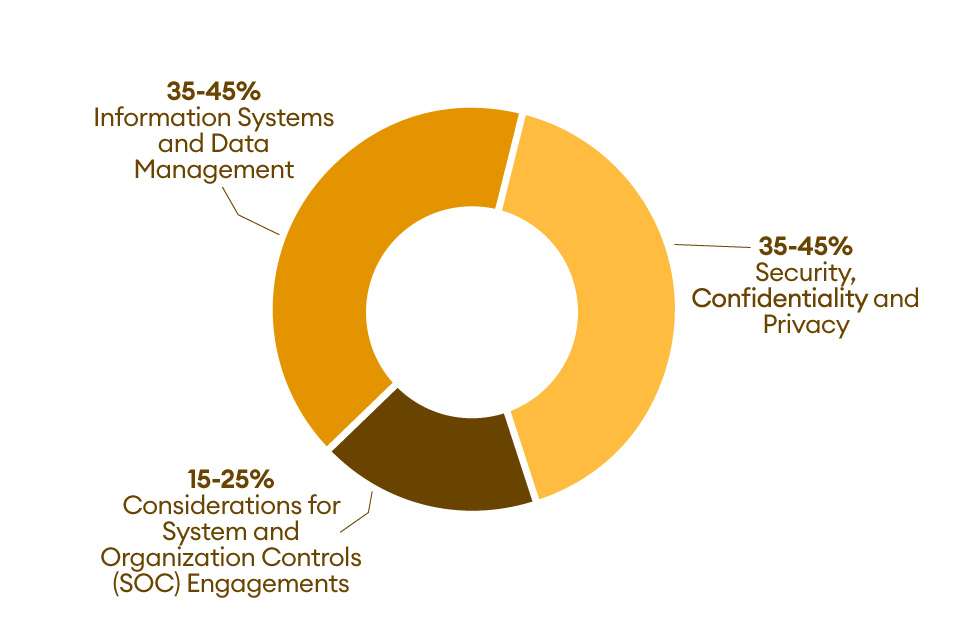

The ISC Discipline section tests the knowledge and skills a CPA must demonstrate with respect to information technology (IT) audit and advisory services, including SOC engagements. ISC also tests the knowledge and skills that CPAs must demonstrate with respect to data management, including data collection, storage and usage throughout the data life cycle.

With respect to SOC engagements, the ISC Discipline Exam section primarily focuses on:

- The use of the Description Criteria for a Description of a Service Organization’s System and Trust Services Criteria for Security, Availability, Processing Integrity, Confidentiality and Privacy in planning, performing and reporting in a SOC 2® engagement

- Planning, certain procedures (excluding the testing of internal controls over financial reporting) and reporting on a SOC 1® engagement

- BEC topics moved to ISC include:

- Business processes and internal controls

- Risks associated with IT and controls that respond to those risks

- Data management and relationships

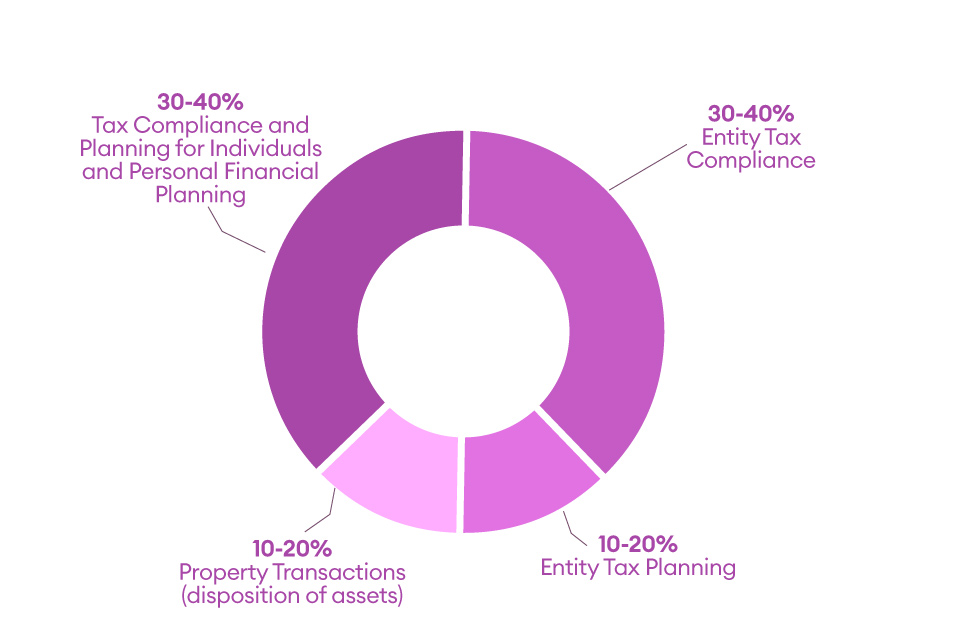

The TCP Discipline section tests the knowledge and skills a CPA must demonstrate with respect to:

- U.S. federal tax compliance for individuals and entities with a focus on nonroutine and higher complexity transactions, U.S. federal tax planning for individuals and entities, and personal financial planning

- The assessment of federal tax compliance will focus on a CPA’s role in both the preparation and review of tax returns. The assessment of federal tax planning will focus on a CPA’s role in determining the tax implications of proposed transactions, available tax alternatives or business structures

- The assessment of personal financial planning will focus on planning strategies and opportunities that a CPA typically identifies in connection with the preparation and review of individual tax returns

As mentioned earlier, the existing REG content will be allocated between the REG Core section and the TCP Discipline section. TCP will focus on nonroutine and higher complexity tasks. The current REG topics that will be moved to TCP include:

- Consolidated C-Corporation tax returns

- International tax issues

Get a 14-day free trial of our leading CPA Exam review

Becker makes sure you’re ready to pass each of the CPA Exam sections by providing the most comprehensive CPA Exam review course available. You’ll have access to over 900 dynamic and visual lecture videos taught by our expert instructors and comprehensive textbooks to help you learn difficult topics. Then, you can test your knowledge with over 8,000 multiple-choice questions and over 500 task-based simulations. Get a 14-day free trial and see exactly how Becker gets you Exam Day ReadySM.