Smarter CPA prep with Becker’s Study Planner

With Becker’s Study Planner you can build a completely customized review plan and schedule that keeps you on track to becoming Exam Day ReadySM.

Set how in-depth you want to study

Build a realistic study schedule around your life, including days off

Track your progress

Know what to watch and practice each day

Recalibrate your schedule in a few clicks if you get off track or fall behind

Set how in-depth you want to study

Build a realistic study schedule around your life, including days off

Track your progress

Know what to watch and practice each day

Recalibrate your schedule in a few clicks if you get off track or fall behind

What makes Becker the #1 choice for CPA Exam prep?

When you’re investing in your future, you need to feel confident that you’re making the right choice. Learn more about how we stand out from other CPA Review courses with four pillars we call The Becker Difference.

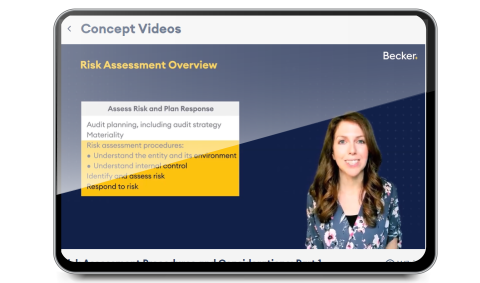

Find the right CPA Review package

All Becker's CPA Exam Review packages include our Exam Day ReadySM toolkit: digital textbooks, 900+ concept videos, 9,000+ multiple-choice questions, 900+ task-based simulation questions, simulated and mini exams, and unlimited academic support. Choose the right package based on the resources you need!

Concierge

Pro+

Pro

Advantage

Unlimited access

Unlimited access

Unlimited access

24-month access

Unlimited Academic support

Unlimited Academic support

Unlimited Academic support

Unlimited Academic support

100% money-back Pass Guarantee

Pass Guarantee

Pass Guarantee

ExamSolver solution videos

ExamSolver solution videos

ExamSolver solution videos

25 success coaching sessions

5 success coaching sessions

5 success coaching sessions

25 1-on-1 tutoring sessions

5 1-on-1 tutoring sessions

5 1-on-1 tutoring sessions

3 Becker Academy courses

1 Becker Academy courses

Deep Dive Workshops

Get a full list of features and find the perfect option for your exam prep needs

The #1 CPA Exam Review course for firms

Over 2,900 organizations trust Becker to help their staff pass the CPA Exam, including The Big 4 and top 100 accounting firms.

Connect with a member of our team to learn more about CPA Exam packages for your firm, organization, or university.

Becker Academy

Getting you CPA Exam review-ready

Set yourself up for success in CPA Exam prep by building a strong foundation in essential accounting concepts, refreshing your understanding or filling in knowledge gaps. Take our free diagnostic assessment to see if Becker Academy is the right first step for you.