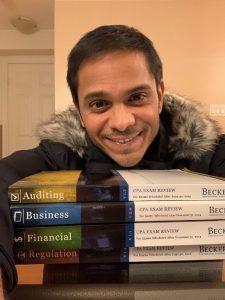

My CPA Exam story: how an international student prepared for success on the CPA Exam

The pursuit of U.S. CPA licensure can be complicated, especially if you’re an international student. Just ask Jason Peter. He was born and raised in Dubai, where he lived most of his life before moving to Canada and pursuing his CPA.

His accounting journey started a bit rougher than most. After failing his Accounting 101 course, he still knew he wanted to continue and earn one of the highest certifications for accountants.

As an international student, CPA preparation requires more research and organization, but overall, Jason’s experience was positive. Despite the obstacles in front of him, Jason went on to earn a 99 on AUD and a 90 on FAR, REG and BEC!

“Thanks to Becker’s content and online study options, I didn’t feel any different from the students that were studying in the U.S.,” he shared.

Read more of Jason’s CPA story, from failing his initial accounting courses to becoming a licensed CPA in the United States, and his words of advice for international students with similar goals.

Why did you decide to pursue accounting?

My decision to pursue accounting stemmed from a failed decision to become an engineer. I lost a year after school trying to become an engineer but quickly decided it wasn’t for me, rather just an attempt to force myself to do what most kids around me were doing. So, I picked accounting. Why accounting? No particular reason – I had a feeling that it’d be a useful skillset at any point in my career, no matter what I eventually chose to do in the long run. Turns out, I wasn’t all that wrong. Plus, numbers are like puzzles and who doesn’t like puzzles?

Unfortunately, my first semester of accounting wasn’t very successful. I failed Accounting 101.

How did you motivate yourself to continue through your accounting courses, despite your previous failure?

It wasn’t easy. The biggest motivation was the fact that my parents were getting closer to retirement and I knew I needed to make a life for myself. It was time to stop being irresponsible and do the right thing. So, I started studying. I’ll admit, it’s not like I spent hours in front of the books. I studied just enough to get through my mid-terms and exams. I managed to get my undergraduate degree in the end. I further went on to pursue a master’s degree in Applied Finance while I was working full time in an accounting role. Again, not the brightest student in class – my grades indicated I did the bare minimum, an approach that would never have worked on a CPA exam, but we’ll get into that soon.

Any tips for students with similar struggles?

Look, we live in a competitive environment. You’ll find a lot of students around you who talk like Einsteins and Newtons. This can be extremely overwhelming to a lot of kids – it most certainly was for me. My biggest tip is to ignore them. Kids have different capabilities and wavelengths. Their ability to absorb information can vary significantly and sometimes they just need to take their time with certain subjects compared to others. Just believe in your skills and tell yourself you can reach the end goal. A “smart” student might pass all four exams in six months and you might take 18 months with a couple of re-takes. Does it really matter? You’ve both reached the same destination. Imagine that destination while you study and tell yourself you are going to get there. Because you will.

What was your biggest challenge in preparing for the exam, and how did you overcome it?

During my university days, I prepared for exams with the sole intent to pass the course, so my studying was rather selective. The CPA exam was a different beast altogether. It required extensive studying, practice, discipline and perseverance. Safe to say, my biggest challenge was fear itself.

I kept asking myself if I was cut out for a certification like this, something only the bright kids in college pursued. I decided to jump straight in without any procrastination and created a study plan with Becker. I created a plan so detailed that it featured what topics I’d cover every single day for the next three months. I made sure to stick to it by sacrificing any other fun activities that came my way. I also factored in busy periods at work. Thanks to Becker’s software, I’d sometimes find myself doing MCQs and SIMs in a transit lounge at an airport during some of my work-related travels. The only thing that was constant in my mind was the end goal. I had to give this my best shot, whether I succeeded or failed was irrelevant. I wouldn’t go down without having tried.

In the end, I passed all four exams on the first try with a 90 on FAR, REG and BEC and a 99 on AUD.

As an international student, how was your experience preparing for the CPA Exam?

As an international student, my experience with preparation was positive. I didn’t know any CPAs besides one of my former managers, who motivated me to pursue this. Thanks to Becker’s content and online study options, I didn’t feel any different from the students that were studying in the US.

Do you have any words of advice for other international students who are considering CPA licensure?

I didn’t do enough research when I started my journey and had to switch states mid-way. My biggest piece of advice is to ensure you have all the eligibility-related information on hand before you decide to start studying. Make sure you pick a state where you know you’ll be able to satisfy all the requirements all the way up to licensure. Remember, passing all four exam sections is pointless if you don’t get the actual license. International students generally have a slightly harder time with some of the licensing rules, especially one that requires work experience to be signed off by a CPA, so pay special attention to this.

Overall, all the extra effort is worth it in the end. You may be one of the very few licensed CPAs in your region and this will give rise to generous opportunities.

Why did you choose Becker for your CPA studies?

I chose Becker mainly because it was recommended by many people around me. The topics were very well structured and explained well, especially by Tim Gearty and Peter Olinto. I sometimes hear their voices in my sleep! Becker’s software is versatile – I had it on my PC, my iPad and my phone and I’d keep listening to lectures of difficult topics while I was commuting to work or any other moments of free time. The question bank was extensive, and concepts were well-explained, even those that were completely foreign to me because of my academic background. Overall, I realized that their program works perfectly if you follow it to the tee.

Let Jason’s story be a reminder that you can do this! Pursuing CPA licensure is never easy – whether you’re an international student or not – but with the right resources and encouragement, it is attainable. Are you ready to begin your CPA journey? Here’s how international students apply for the CPA Exam.