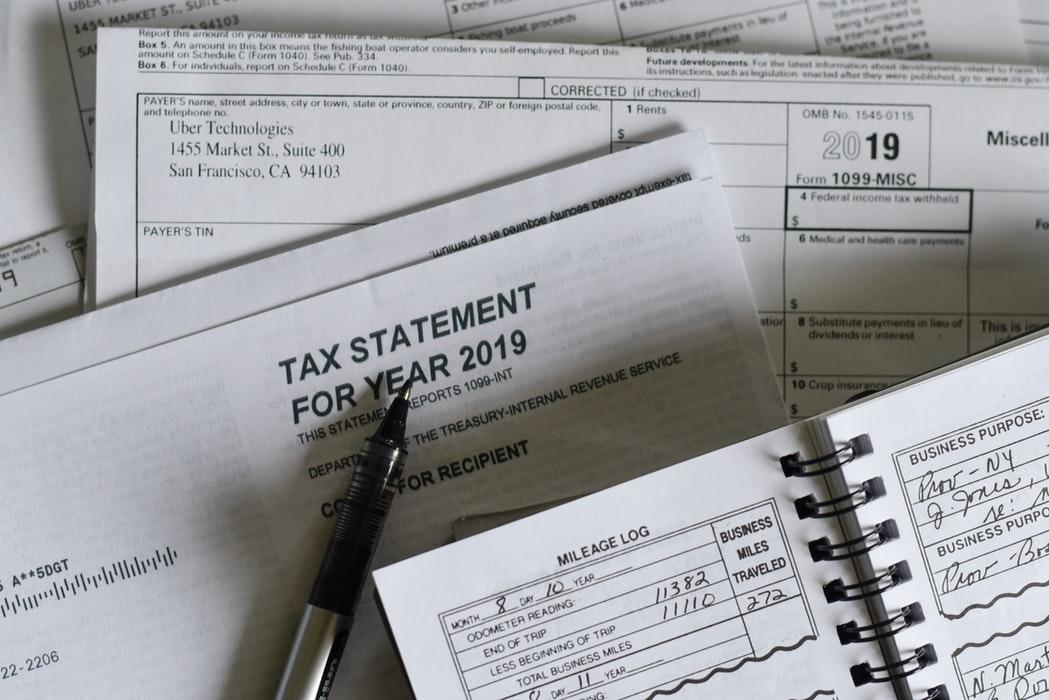

The IRS has issued draft forms for 2020. This article reviews a few of the new forms and changes to the 1040 and W-2 that are important for tax practitioners and their clients.

Form 1099-NEC (Nonemployee Compensation): This new form is used to report nonemployee compensation. These amounts used to be reported on Form 1099-MISC. Starting this year, qualified payments will be shown on Form 1099-NEC.

The instructions say to file this form for each person to whom, in the course of a trade or business, at least $600 was paid from:

- Services performed by someone who is not an employee (including parts and materials);

- Cash payments for fish that are paid to anyone who is in the trade or business of catching fish; or

- Payments to an attorney

Form 1099-NEC must also be filed where the business withheld income tax under the backup withholding rules, regardless of the payment amount.

Generally, payments to corporations (including LLCs taxed as corporations) do not have to be reported on Form 1099-NEC. However, payments reported in box 1 for attorney fees and cash purchases of fish must be reported even though the payments were made to a corporation.

Observation: Remember that with respect to the section 199A deduction, the IRS has stated that, if your client is in the trade or business of rental real estate, they should probably be filing Form 1099’s. You would not need to worry about this if your client fell under the protection of the safe harbor for rental real estate.

Form 7202 (Credits for Sick Leave and Family Leave Credit for Certain Self-Employed Individuals):

This new form is for the self-employed who qualify for the new sick leave and family leave credits. For year-end tax planning, it is important to remember that we may have clients who qualify for these credits. To do so, they need to satisfy the same criteria that are required of employees. Basically, they had to miss work because of COVID-19 reasons. These reasons include caring for someone else who is quarantined or caring for a child whose school is closed or childcare provider is not available because of COVID-19 precautions.

In a related change, Form W-2 will have a special designation where wages were paid for qualified sick leave and/or family leave. This is because there are caps to the amount of wages paid that qualify for the two credits. If someone who is self-employed was paid qualified sick leave or family leave wages, they must reduce their otherwise qualified credit by those amounts.

Form 1040 changes

Line 10b – Charitable contributions if you take the standard deduction

A maximum $300 deduction is allowed for those who make charitable contributions but don’t have enough deductions to itemize. Clients aged 70 ½ can also continue to contribute up to $100,000 per year directly from their IRA to charity. A charitable deduction is not allowed, but the IRA distribution is not included in income.

Line 30 – Recovery rebate credit

A credit of up to $1,200 for an individual ($2,400 for married filing jointly) and $500 for qualified children under 17 is available for 2020. For most taxpayers who qualify, these amounts were paid in 2020 as an advance against this credit. For those persons who received the full amount, there will be no additional credit.

Some taxpayers did not receive the advance payment. To qualify for the full credit, the AGI must not exceed the following thresholds:

(1) $150,000 for Married filing jointly,

(2) $112,500 for Head of Household, and

(3) $75,000 for other taxpayers.

The credit is reduced by 5% of the AGI that exceeds those amounts.

Observation: The credit completely phases out for those without children at $198,000 AGI for MFJ and at $99,000 AGI for singles.

What about a client who received an advance payment but their 2020 AGI is too high to otherwise qualify? They get to keep the advance payment - they don’t have to pay it back.

Line 37 – Amount you owe

There is a new note that says: “Schedule H and Schedule SE filers, line 37 may not represent all of the tax you owe.” This is because those filers could have chosen to participate in the delay of payment of employer payroll taxes. This is the 6.2% of the employer portion of the Social Security (OASDI) tax.

There will likely be additional form changes and perhaps some new tax laws as the year goes on.

The content contained in this article is for informational purposes only and is not tax advice. You should consult a tax advisor for advice applicable to your situation.

John M. Stevko has over 40 years of professional experience as a tax practitioner, national seminar instructor, writer and business owner. John began his career with what is now a “Big 4” public accounting firm before founding a local CPA firm in Beaverton, Oregon. At the same time, John began speaking for Gear Up Tax seminars, eventually becoming a managing partner of the business. John has lectured on tax law and healthcare reform throughout the country at national conferences and in-house for top 100 CPA firms and the large banking industry. John is a graduate of the University of California at Davis.