The need for reporting on Environmental, Social, and Governance (ESG) matters is becoming increasingly common in companies and organizations for both regulatory and voluntary transparency reasons. Shareholders and stakeholders including investors, lenders, customers, and employers want to see metrics related to sustainability performance and social responsibility, and this is driving a higher demand for ESG accounting and personnel who can understand the potential enterprise-wide impact on operational, compliance, strategic, and reporting objectives.

We are providing a closer look to help you understand ESG reporting and sustainability accounting and the skills you may need to focus more on this area of the profession.

What is ESG reporting?

If you’re new to this topic, ESG refers to environmental, social, and governance which are the three non-financial pillars companies report on to align with new regulations and provide transparency to investors.

Sometimes called ESG accounting or sustainability accounting, this extends beyond traditional accounting and financial statement reporting to focus on ESG reporting. This involves measuring, analyzing, and reporting how an entity’s activities impact climate, diversity, corporate governance, and similar factors.

Examples may include:

- Quantifying the greenhouse gases a company’s production facilities emit

- Whether a company uses recycled materials during production

- Disclosing employee salaries by gender

- Supply chain labor, health, and safety standards

- Shareholders’ rights

- Executive compensation

ESG reporting may be integrated into financial reporting to provide stakeholders with a more comprehensive understanding of a company’s sustainability performance alongside its financial health.

Governing boards in ESG accounting and reporting

Several governing boards and frameworks guide ESG reporting standards:

- Global Reporting Initiative (GRI): Offers a comprehensive set of sustainability reporting standards, widely adopted for disclosing ESG impacts

- Sustainability Accounting Standards Board (SASB): Focuses on industry-specific standards, helping companies disclose financially material ESG information

- Task Force on Climate-Related Financial Disclosures (TCFD): Provides guidelines for disclosing climate-related risks and opportunities in financial filings

These frameworks ensure consistency and comparability in ESG reporting, facilitating informed decision-making by stakeholders.

What is the role of an ESG accountant?

While it extends beyond traditional financial statement reporting, accounting and finance personnel still play a critical role in successfully implementing ESG reporting initiatives. They can assist entities to achieve ESG objectives by incorporating relevant data into the accounting and financial reporting processes and systems, and they can aid in verifying the accuracy and reliability of data used to calculate ESG metrics.

In addition, the preparation and fair presentation of financial statements under Generally Accepted Accounting Principles (GAAP) must consider the impact of ESG-related matters. For example, the impact of environmental changes on the useful lives of assets held and used in operations, recoverability of inventory, regulatory fines, customer product return patterns and more.

An ESG accountant may focus more on non-financial metrics, such as carbon emissions, diversity ratios, or community engagement. They analyze ESG data to assess its impact on business operations, risk management, and stakeholder relationships, and while they primarily work in financial departments, they collaborate extensively across organizational functions, including audit, compliance, and sustainability teams.

Skills needed in sustainability accounting and ESG reporting

Becoming a sustainability accountant or working in ESG reporting requires you to have requires additional skills and knowledge beyond traditional accounting:

- Understanding ESG Standards: Proficiency in ESG frameworks, including those listed above like GRI, SASB, and TCFD, is essential for interpreting and applying reporting guidelines.

- Risk management expertise: Awareness of risks and uncertainties associated with ESG factors enables effective identification and mitigation strategies.

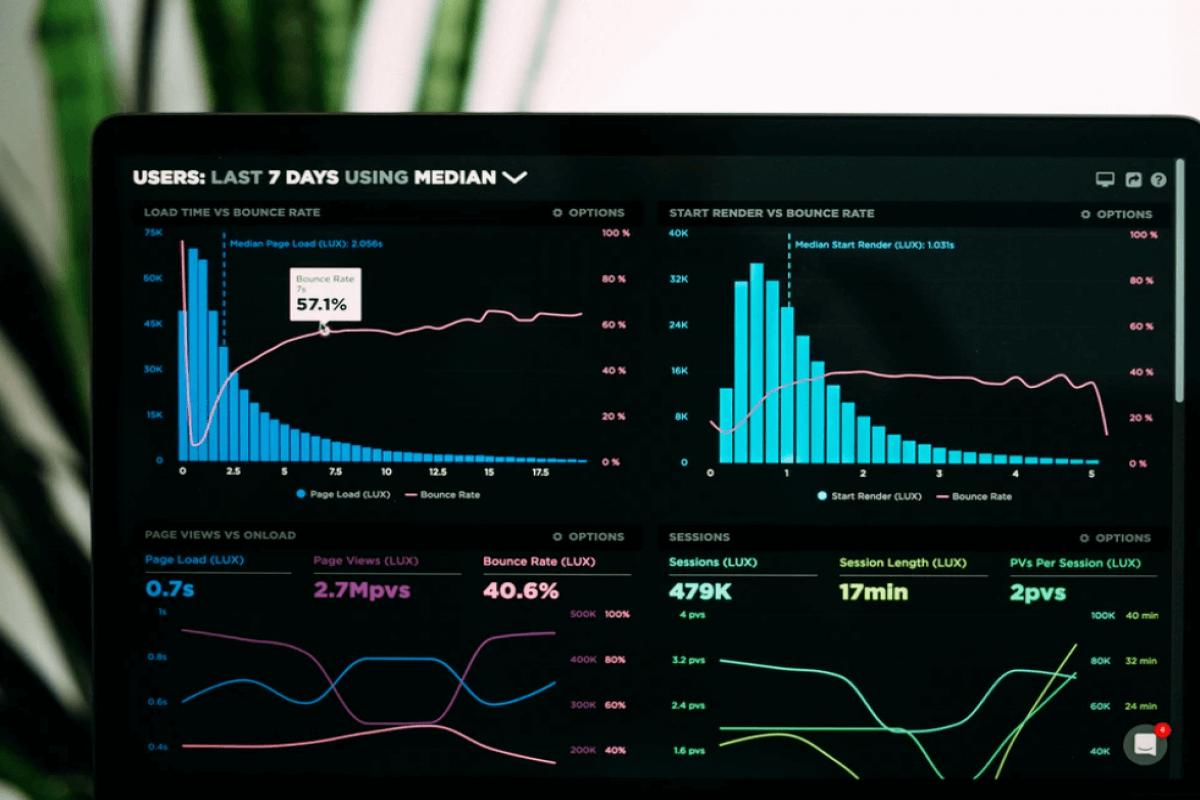

- Data management skills: Ability to capture, analyze, and manage ESG data ensures accurate reporting and informed decision-making.

- Data visualization and project management: Proficiency in visualizing ESG metrics and driving organizational change through effective project management enhances reporting efficiency and transparency.

Take the next step to learn about ESG reporting and sustainability accounting with Becker

As ESG reporting is in high demand, so is the need for professionals who can compile these reports and provide insight to shareholders and stakeholders about the qualitative and quantitative benefits of an entity’s ESG activities. If you are considering making the shift from traditional accounting or audit to ESG, we can help you gain the knowledge and skills you need through our CPE courses, including:

- Why Incorporate Environmental, Social, and Corporate Governance (ESG)

- Accounting and Attest Engagements for ESG

- Bringing an Ethical Mindset to ESG