If you're planning to sit for a CPA Exam section in 2026, on the way to your Certified Public Accountant license, it's important to keep up with the latest CPA Exam blueprint and any CPA Exam changes in the upcoming year to ensure that you're studying the most accurate information.

Every year, The American Institute of Certified Public Accountants (AICPA) publishes a blueprint. Here, we're sharing this 2026 CPA Exam blueprint, outlining the format and content that candidates can expect to encounter on the exam.

A summary of the CPA Exam blueprint

All candidates must pass three Core sections that focus on knowledge and skills that are universal to all CPAs. They must also pass one of three Discipline sections that focus on a specialized knowledge area.

The 2026 CPA Exam blueprint doesn't bring significant changes, but even small changes can affect how you study, so keep reading to learn more.

Jump ahead

- Why change the CPA Exam blueprint?

- Changes to the 2026 CPA Exam

- CPA Exam section content

- CPA Exam section structure and scoring

- CPA Exam skill levels

Why change the CPA Exam blueprint?

Sweeping CPA Exam changes started following an AICPA report1 published in 2019. The report showed that accounting firms were hiring fewer accountants and investing more in employees with stronger competency in technology and data analytics. A gap analysis showed that recent accounting graduates were skilled in data analytics and IT audits, but were less skilled in cybersecurity, IT governance, or Systems and Organization Control (SOC) engagement. To address these gaps and ensure that the accounting degree is still relevant, the AICPA and NASBA worked together to transform the "old" CPA Exam, releasing a totally restructured version in 2024 with CPA Evolution.

Although the 2026 CPA Exam blueprint doesn't change the new structure or format, the AICPA does provide minor updates to the exam content (and the blueprint) to factor in changes in regulation and law, as well as to continually reflect the needs of the profession.

Changes to the CPA Exam structure

The 2026 CPA Exam format still includes these three Core exams:

- Auditing and Attestation (AUD)

- Financial Auditing and Reporting (FAR)

- Taxation and Regulation (REG)

Candidates must also pass one of three Discipline sections. Each one is centered on more specialized knowledge and skills gained in the Core sections:

- Business Analysis and Reporting (BAR)

- Information Systems and Controls (ISC)

- Tax Compliance and Planning (TCP)

CPA Exam section content

Core section - Auditing and Attestation (AUD)

The AUD Core section tests knowledge and skills you will need to show when performing audit engagements, attestation engagements, and accounting and review service engagements.

Content areas

- Area I: Ethics, Professional Responsibilities, and General Principles is allocated 15 to 25%

- Area II: Assessing Risk and Developing a Planned Response — 25 to 35%

- Area III: Performing Further Procedures and Obtaining Evidence — 30 to 40%

- Area IV: Forming Conclusions and Reporting — 10 to 20%

2026 blueprint changes

- Revised the References of the Section Introduction to reflect the AICPA Quality Management standards.

- Revised a Topic name in Area II (Control environment, IT general controls, and entity-level controls), two representative tasks in that Topic to emphasize entity-level controls, and one representative task in one Topic in Area III (External confirmations).

- Added examples to representative tasks in one Group in Area II (Assessing and responding to risks of material misstatement, whether due to fraud or error) and one Topic in Area III (External confirmations).

- Revised a representative task in one Topic in Area III (Accounting estimates) to clarify that the inputs to an accounting estimate include methods and data.

Core section - Financial Accounting and Reporting (FAR)

The FAR Core section tests the knowledge and skills needed with respect to financial accounting and reporting frameworks, including those issued by the Financial Accounting Standards Board (FASB), U.S. Securities and Exchange Commission (U.S. SEC) and the AICPA for use by both for-profit and non-profit entities.

Content areas

- Area I: Financial Reporting is allocated 30 to 40%

- Area II: Select Balance Sheet Accounts — 30 to 40%

- Area III: Select Transactions — 25 to 35%

2026 blueprint changes

- Revised the References of the Section Introduction to remove an AICPA Practice Aid on cash and tax basis financial statements that is no longer being maintained by the AICPA.

- Revised one representative task in one Topic in Area I (Statement of activities) to clarify scope.

- Revised the examples in one representative task in one Group in Area I (Financial Statement Ratios and Performance Metrics).

- Removed two representative tasks and added one representative task in one Group in Area III (Fair value measurements) to clarify the scope of the testing of fair value measurement concepts in FASB Accounting Standards Codification Topic 820, Fair Value Measurement, in the FAR and Business Analysis and Reporting sections.

Core section - Taxation and Regulation (REG)

The REG Core section tests the knowledge and skills concerning U.S. ethics and professional responsibilities related to tax practice, U.S. business law, and U.S. federal tax compliance for individuals and entities with a focus on recurring and routine transactions.

Content areas

- Area I: Ethics, Professional Responsibilities and Federal Tax Procedures is allocated 10 to 20%

- Area II: Business Law — 15 to 25%

- Area III: Federal Taxation of Property Transactions — 5 to 15%

- Area IV: Federal Taxation of Individuals — 22 to 32%

- Area V: Federal Taxation of Entities (including tax preparation) — 23 to 33%

2026 blueprint changes

- Added an assumption in the Section assumptions of the Section Introduction and revised one representative task in one Group in Area IV (Adjustments and deductions to arrive at adjusted gross income and taxable income) in response to the provisions in H.R. 1, One Big Beautiful Bill Act (the Act), that will allow for additional deductions in the calculation of adjusted gross income and taxable income.

- The changes are being made as part of this update so that the CPA Examination Blueprints do not need to be reissued when the provisions of the Act become eligible for testing. The provisions of the Act with effective dates in 2024 and 2025 will become eligible for testing in the REG section starting on July 1, 2026. All other provisions of the Act will become eligible for testing in the calendar quarter beginning six months after the provision’s effective date. Provisions that were scheduled to sunset in 2025 before the signing of the Act will continue to be eligible for testing through June 30, 2026.

- Revised a representative task in one Group in Area III (Cost recovery (depreciation and amortization)) to clarify scope.

Discipline section - Business Analytics and Reporting (BAR)

The BAR Discipline section tests more complex technical accounting topics than those covered by FAR. More specifically, this section assesses knowledge and skills related to:

- Analyzing financial statements and financial information

- Select technical accounting and reporting requirements under the FASB and SEC

- Financial accounting and reporting requirements under GASB that are applicable to state and local government entities

- Data and technology concepts, such as verifying the accuracy of sources used to analyzed financial statements and information and determining methods to transform data into a valuable tool used in decision-making.

- Applied research, focusing on reviewing and using source materials to complete tasks, including identifying problems, analyzing facts, and determining appropriate responses

Content areas

- Area I: Business Analysis is allocated 40 to 50%

- Area II: Technical Accounting and Reporting — 35 to 45%

- Area III: State and Local Governments — 10 to 20%

2026 blueprint changes

- Removed one representative task and added one representative task in one Topic in Area I (Investment alternatives using financial valuation decision models) to clarify the scope of the testing of fair value measurement concepts in FASB Accounting Standards Codification Topic 820, Fair Value Measurement, in the BAR and FAR sections.

- Revised a representative task in one Topic in Area I (Investment alternatives using financial valuation decision models) to add an example and clarify scope.

Discipline section - Information Systems and Controls (ISC)

The ISC Discipline section tests the knowledge and skills concerning information systems, including processing integrity, availability, security, confidentiality, and processing. It also covers topics a CPA must be competent in related to data management, including data collection, storage, and usage throughout the data life cycle. It also assesses the knowledge and skills related to information technology (IT) audit and advisory services, including SOC engagements.

Content areas

- Area I: Information Systems and Data Management is allocated 35 to 45%

- Area II: Security, Confidentiality, and Privacy — 35 to 45%

- Area III: Considerations for System and Organization Controls (SOC) Engagement — 15 to 25%

2026 blueprint changes

- Updated the References of the Section Introduction to

- Reflect the renaming of the AICPA’s SOC 1 Guide.

- Add sections of the Health Insurance Portability and Accountability Act of 1996 (HIPAA) that define key terms used in sections of that Act that are currently eligible for testing in the ISC section.

- Remove the reference to the specific version of the National Institute of Standards and Technology (NIST) Privacy Framework to allow for future version changes.

- Reflect the issuance of a new version of the Payment Card Industry Data Security Standard (PCI DSS) Quick Reference Guide.

- Add Data Analytics to the eligible categories of textbooks.

- Revised three representative tasks and added two representative tasks to one Topic in Area I (Change management) to add examples and clarify scope.

Discipline section - Tax Compliance and Planning (TCP)

The TCP Discipline section will assess skills and knowledge related to U.S. federal tax compliance for individuals and entities, U.S. federal tax planning for individuals and entities, and personal financial planning.

- Federal tax compliance emphasizes nonroutine and complex transactions and focuses on your role in preparing and reviewing tax returns.

- Federal tax planning focuses on your role in analyzing the tax implications of proposed transactions, available tax options, or business structures.

- Personal finance planning focuses on the strategies and opportunities typically identified by CPAs in connection with individual tax return preparation and review.

Content areas

- Area I: Tax Compliance and Planning for Individuals and Personal Financial Planning is allocated 30 to 40%

- Area II: Entity Tax Compliance — 30 to 40%

- Area III: Entity Tax Planning — 10 to 20%

- Area IV: Property Transactions (disposition of assets) — 10 to 20%

2026 blueprint changes

- Added an assumption in the Section assumptions of the Section Introduction in response to the provisions in H.R. 1, One Big Beautiful Bill Act (the Act), that will allow for additional deductions in the calculation of adjusted gross income and taxable income.

- The change is being made as part of this update so that the CPA Examination Blueprints do not need to be reissued when the provisions of the Act become eligible for testing. The provisions of the Act with effective dates in 2024 and 2025 will become eligible for testing in the TCP section starting on July 1, 2026. All other provisions of the Act will become eligible for testing in the calendar quarter beginning six months after the provision’s effective date. Provisions that were scheduled to sunset in 2025 before the signing of the Act will continue to be eligible for testing through June 30, 2026.

- Removed a representative task from one Topic in Area II (International tax issues) as the concepts will no longer be eligible for testing in the TCP section.

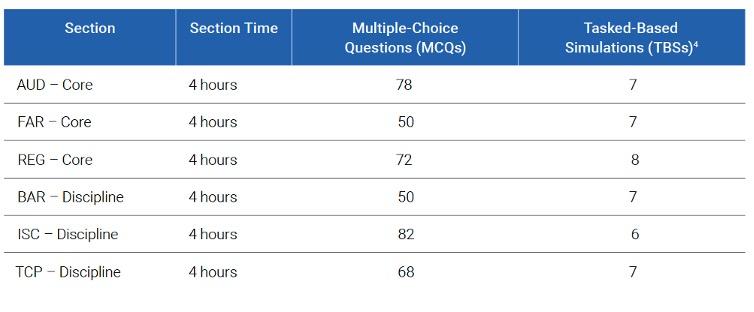

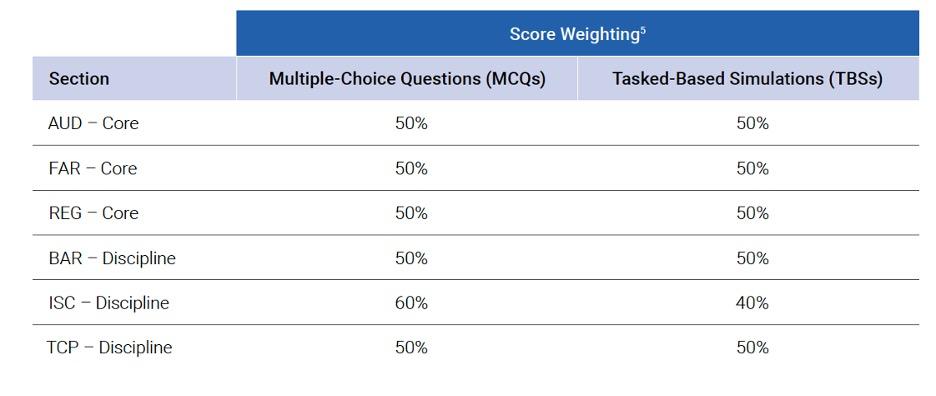

CPA Exam section time and question count

All candidates have four hours to complete each section of the exam, including Core sections and Disciplines, unless you have requested and were granted CPA Exam accommodations. Within the individual sections, there are two testlets consisting of multiple-choice questions (MCQs) and three testlets consisting of task-based simulations (TBSs).

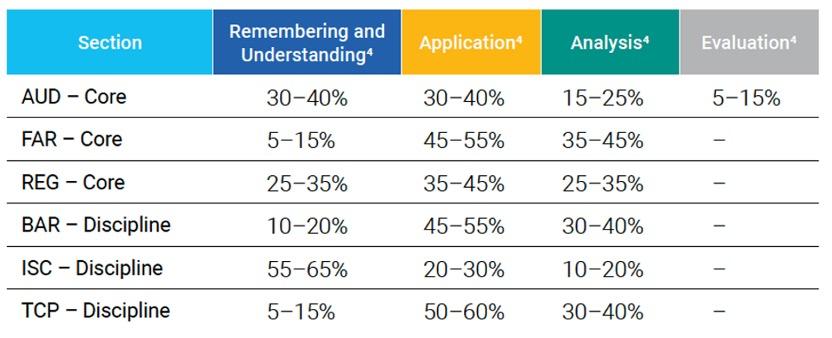

Skill levels in the CPA Exam blueprint

The 2026 CPA Exam blueprint has the same skill level categories as previous iterations: remembering and understanding, application, analysis, and evaluation.

The table below outlines the skill level categories within each CPA Exam section:

Becker gets you Exam Day ReadySM

Becker works closely with the AICPA to ensure our CPA Exam Review reflects the 2026 exam blueprint. We continually update our review course and materials to align with the exam and provide the best possible experience to our students.

Download our FREE CPA Exam ebook

If you want to learn more about the CPA Exam, download our free CPA Exam guide for 2026 and get a clear look at what you can expect. What's inside?

- An overview of the CPA Exam

- Comprehensive details of each section, including the exam format, section times, scoring details, and key content areas

- Choosing your Discipline

- Do's and don'ts to get ready for the CPA Exam

- Exam study tips

- Multiple-choice practice questions