Try out Becker CPE

CPE value that fits your life and learning style

As the #1 name in CPA education, you can trust Becker to provide the leading continuing professional education (CPE) solutions to help you advance your career and meet your CPE requirements. Becker's vast selection of courses are available in flexible self-paced or live streaming formats and taught by industry-leading experts to provide a tailored experience that suits your lifestyle, professional interests, and learning preference.

We’re here to answer your questions about CPE

Continuing Professional Education (CPE) is ongoing education and training that’s essential for you, as an accounting, finance or tax professional, to maintain your professional license and to improve your competency and expertise. You earn one CPE credit for every 50 minutes of approved CPE coursework.

Continuing Professional Education (CPE) courses are crucial to stay up to date on best practices and the latest developments in accounting and finance, whether you are a CPA, CMA, tax preparer or other accounting or finance professional.

To earn Continuing Professional Education (CPE) credits, start by selecting a reputable CPE provider, like Becker. Be sure the courses you choose will count toward your professional education requirements. Popular ways to earn CPE credits in your areas of interest include professional seminars, workshops or conferences, and live webcasts or on-demand courses. You can even register for a FREE Becker CPE course and earn FREE CPE credit now here.

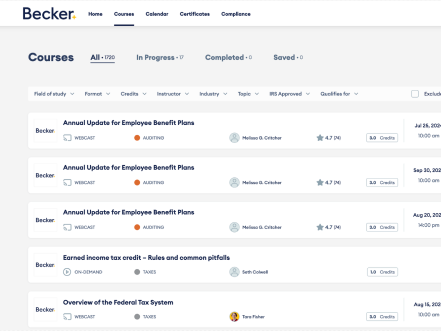

Absolutely! Earning CPE credits online offers ultimate flexibility for many CPAs and other accounting professionals. Becker offers the industry’s largest selection of online CPE courses with more than 1,700 course choices in 19 areas of specialty. Take a look at our full course catalog here.

Yes. Remember to keep your certificates of completion for at least 5 years, if you are a CPA. State Boards may perform routine audits at any time and will require proof of course completion. If you are a CPA, you can submit CPE certificates to your State Board as you complete them. CMAs can submit CPE certificates to the Institute of Management Accountants (IMA®).

This answer depends on your license, certification, and state where you practice. Some states do not have an expiration date on CPE credits, but the time frame varies by state. Check with your own State Board for the latest rules.

Some states do allow you to carry over excess CPE credit hours to the following year. For your specific state, check with your Board of Accountancy. As a CMA, you can carry up to 10 CPE credit hours forward. For more information on earning CPE credits for the year, visit the Becker CPE course catalog here.

As the #1 name in CPA education, Becker CPE courses not only provide in-depth knowledge to further your career, but they are also taught by industry-leading instructors who emphasize practical applications that can benefit you in everyday business situations. In fact, 96% of professionals say Becker CPE meets all their CPE needs and users give Becker a 9 out of 10 rating for quality content. Chances are if you ask a colleague, they will recommend Becker CPE courses because of the outstanding selection, flexibility and quality of instruction – whether online live, or on-demand.