If you want a career with security and growth opportunities, where you can dig into data and create strategies that help clients understand their finances, plan for the future, and build wealth, the knowledge you need starts in college. Most likely, you’re weighing your options between finance vs accounting, as either path will equip you to work with individual clients, small businesses or large corporations, but which major is the best option?

Deciding between these degrees starts with knowing how they are different and which major may better fit your goals. To help you decide, we’re digging into the differences (and similarities) in skills, even future career paths and salary expectations, so you can choose the best option.

Summary

While distinct, finance and accounting share a foundation and both set you up for sought-after jobs and growth prospects. The main difference between finance vs accounting lies in their scope and focus, and the choice between them depends on your interests and career goals:

- Choose accounting if you are interested in reporting on past and current data. Accounting digs into financial reports, analyzes and organizes past data, spots anomalies and patterns, and focuses on professional principles and processes.

- Choose finance if you are more interested in strategizing for the future. Finance focuses on financial strategy and control, follows financial markets, analyzes investments, predicts future growth, and uses quantitative data for financial modeling.

We also suggest exploring internships and experiential learning to gain a feel for what each career path entails and to help you make an informed decision.

Table of contents

- What's the difference in finance vs accounting?

- Finance vs accounting majors

- What are finance vs accounting career paths?

- Which pays more: finance vs accounting?

- Which one is better?

Before you get started, listen to Becker National Instructor, Mike Brown share the top reasons to become an accountant!

What's the difference in finance vs. accounting?

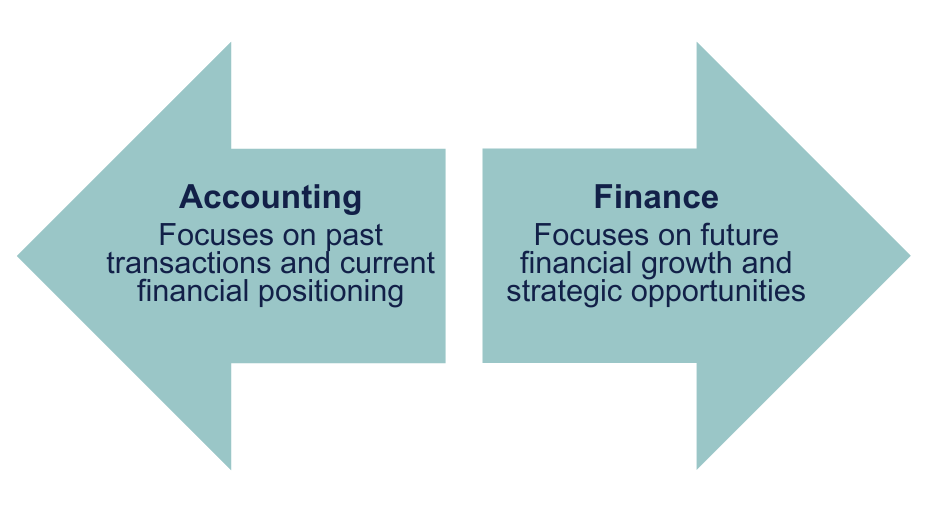

The main difference between finance and accounting is in their scopes and goals. At its most basic, accounting focuses on looking at past transactions to determine current financial positioning while finance deals with analysis and strategy to support future growth.

Let’s compare more closely:

| Finance | Accounting |

| Overall management of assets and liabilities | Daily movement of money in and out of an institution |

| Big-picture planning for future goals | Bookkeeping, reporting and summarizing accounts and spending |

| Strategy for revenue growth and loss prevention | Ensuring the accuracy of account transactions, statements and balances |

What is finance?

Finance is the science of asset planning, management and distribution to achieve growth and increase returns. Finance professionals help secure a successful financial future and reduce the risk of loss for individuals, companies and governments.

A successful career in finance requires keen analytical skills and an eye for strategy. Professionals study topics like investment opportunities and capital management to optimally allocate resources and create value.

What is accounting?

Accounting is a broader field that starts with the precise bookkeeping of an individual, company or government’s financial transactions. This includes summarizing accounts, ensuring accuracy and legal compliance and preparing financial documents like taxes, audit reports and financial statements. Accountants also use their reports and data to advise on budgeting and forecasting. They need to be meticulous and analytical, with great attention to detail and a thorough knowledge of applicable laws, regulations and best practices.

Finance vs accounting majors

When you consider the college coursework for finance vs accounting degrees, there is quite a bit of overlap but there are several key differences, especially during the last few semesters when you’re taking higher level, more advanced classes.

Finance major

As a finance major, you will take courses where you’ll learn about investments, risk management, financial statement analysis, corporate and international finance and economics. You will apply high-level math and statistics skills in classes like quantitative methods, economic forecasting, financial modeling and other topics. Of course, every college requires different classes and offers a variety of electives, but the goal is to provide you with an in-depth understanding of financial theory, analysis and practice so you will be ready for a career in banking, financial planning and other areas.

Finance majors may also choose from several specializations that prepare you for distinct career paths. A few of these areas include FinTech, general finance, real estate, corporate finance and financial planning or wealth management.

- FinTech: The use of technology to streamline and improve financial services

- General finance: The broad term describing the study of money and investments in public, personal and corporate finance

- Real estate: Finance as applied to real estate, specifically how homes, buildings, and plots of land are purchased, and how it relates to loan management and investment opportunities

- Corporate Finance: financial management for businesses

- Financial Planning: Using financial data in the present (income, spending, debt or saving) to map out a beneficial strategy.

Accounting major

The courses for accounting, on the other hand, will teach you accounting theory, tax law, accounting ethics and generally accepted accounting practices (GAAP). You’ll also learn how to prepare and analyze financial statements, perform cost analyses and audit organizations. Standard courses to expect are financial accounting, taxation, business law, accounting information systems and auditing.

As you continue to advance in the program, you may choose an area of specialization like:

- Tax planning: A deep dive into auditing, economics, finance and management in relation to tax laws, while studying how these regulations impact partnerships and corporations

- Public accounting: Expertise in auditing, tax, consulting and financial reporting for individuals, corporations and government

- Forensic accounting: Investigative skills and accounting knowledge used to detect and prevent financial crimes

- Managerial accounting: Strategic financial planning, budgeting and assessment

What are finance vs accounting career paths?

Choosing an accounting vs finance degree really boils down to what career paths are most appealing to you and which will help you earn a top-notch job position. A finance degree opens the door to careers like:

- Entry level

- Junior financial analyst: Gather and analyze financial information, assisting with the preparation of forecasts and budgets

- Loan officer: Assist individuals and businesses in choosing and applying for a loan

- Mid level

- Financial examiner: Monitor financial transactions and ensure compliance with the law

- Insurance analyst: Evaluate risks and profits associated with insurance policies, make updates, verify records and increase efficiency for both the insurance company and policyholders

- Senior level

- Investment banker: Raise capital through complex financial transactions including issuing securities, as well as acquisitions, mergers and sales

- Personal financial advisor: Offer tailored financial and investment advice based on each client’s specific needs

- General and operations manager: Oversee all company or institution’s operations with the goal to improve efficiency and increase profits

Graduating in accounting leads to jobs like:

- Entry Level

- Revenue agent: Work with the IRS or other government entities to examine and audit tax returns

- Fund accountant: Perform accounting duties and reporting for a fund (investment, private equity, non-profit, real estate, etc.)

- Bookkeeper: Record and maintain the financial transactions of a business or institution

- Mid-level

- Public accountant (CPA): provide accounting services for multiple clients, individuals or corporations after earning your CPA license

- Corporate accountant: Provide accounting services internally, for a single organization

- Financial examiner: Monitor financial transactions and ensure compliance with the law

- Tax manager: Ensure tax compliance, prepare and submit tax returns and analyze tax laws

- Senior level

- Auditor: Determine whether financial reports accurately follow GAAP

- Controller: Oversee a company’s accounting operations, reporting and compliance

- Forensic accountant: combine accounting and investigative best practices to research, reveal or prevent criminal financial action

These lists are far from exclusive but do provide an idea of the type of functions available for financing vs accounting graduates in corporate, personal, government and even non-profit sectors.

Which pays more: finance vs accounting?

Both finance and accounting degrees offer a range of well-paying job prospects. That said, the average starting salary is slightly higher for finance vs accounting degrees. In 2023, the National Association of Colleges and Employers (NACE)1 reported that the medium starting salary for finance majors was $61,456, while the medium starting salary for accounting majors was $53,444.

However, there are several factors to consider that can affect earning potential:

- Location: Living in a higher cost-of-living area will affect your income and earning potential

- Career path: While the average salary for a finance major is higher than that of an accountant, individual jobs in accounting may pay much more than specific jobs in finance.

- Licensure and certification: Earning your CPA license or CMA certification will open the door to greater career opportunities and often, a much higher salary

Finance vs Accounting degree: Which is better?

Only you can answer this question! Both finance and accounting set you up for sought-after jobs and growth prospects. Answering which major is a better fit for you boils down to your interests and career goals. Do you want to dig into financial reports, analyze data, or take on the IRS? Or would you rather follow the financial markets, analyze investments, and focus on future strategies? Do you have a strong attention to detail, enjoy organizing data and spotting anomalies or finding patterns? Or do you prefer a future-focused look at financial modeling and using quantitative data?

If you’re leaning to the first options, an accounting degree is likely to be the right path. If the second option sounds more appealing, you may want to consider a finance degree. Think about what you like studying now, as well as what you want to be doing in 10 years.

Learn how to thrive in your career with Becker

If you're already about to start your new accounting career, you probably have some questions. Don't worry, Becker asked hundreds of top accountants and CPAs what they wish they knew and tips to succeed and we put it all together in one course: .

From learning how to prioritize and take ownership of tasks to building better relationships and setting boundaries, you'll have the strategies and confidence you need to thrive!