Many people take the CPA Exam at the start of their careers when everything is still “fresh” in their minds. But this doesn’t mean you can’t take the exam later in your professional journey or with any less success. In fact, the wisdom you have from prior work and life experiences can actually help you clarify your professional goals and priorities. Your self-knowledge can give you greater confidence and conviction to go after the career you want for the life you have now.

This was Anne Kendall’s unforeseen trajectory. After pausing her career in finance to prioritize her family, she eventually found another fulfilling and successful career by becoming a CPA at 61. If you think you can’t do hard things or thrive at something new, Anne is proof that you absolutely can--and at any age.

A go-getter at home and in the office

Anne and her then-husband had demanding jobs on Wall Street early in their careers. But when they were ready to start a family, they knew they needed a lifestyle change. They moved from the “wonderful hecticness” of New York City to a “kinder, gentler life in Milwaukee” so that her husband could take a less stressful job and she could focus on raising their kids.

Fast-forward 15 years: Anne found herself on a mission to jumpstart her career. She always loved the business world but didn’t want to go back to the long hours of investment banking. Speaking candidly, she wasn’t sure if the finance industry would hire a “woman in her 50s” either.

After researching the best way to navigate a career re-entry with her existing skillset, she decided to bridge the gap with a Master’s degree in Accounting, followed by a CPA license. While it may sound easy on paper, the road to achieving these two major milestones took a lot of patience, grit, and self-belief.

Give yourself a personal and professional “audit”

Before you dive headfirst into a big commitment like getting your CPA license, take the time to understand where you are personally and professionally. As Anne did, ask yourself honest questions to ground your goals:

- Where else can your current skills and experience be easily applied?

- What skills and knowledge gaps do you have? How will you fill them?

- What are the market realities and job opportunities for where you are right now and in a few years?

- Do you have the time and resources to achieve it?

Answering these questions can help clarify your “why” and define how you’ll reach your goal.

Leverage what you already know to clarify direction

Restarting isn’t the same as starting over. Use your past work experiences to inform your transition strategy and what you want in your next opportunity.

Since Anne had been out of the workforce for 15 years, she wanted to leverage her prior expertise in finance to make her comeback easier. Getting her master’s degree was a sensible steppingstone that refreshed her skills and got her up-to-speed on what she had missed.

Still, Anne was on the fence about getting her CPA license. But wanting to optimize her earning potential and job prospects, she opted to go the extra mile after learning a career in tax would check off all her must-haves.

Project-manage your studying

Anne’s employer gave her 10 hours per week of paid study time, which allowed her to take a month of unpaid leave to study before each of her four exams. But even with weeks of focused study time baked into her schedule, getting through the work wasn’t easy.

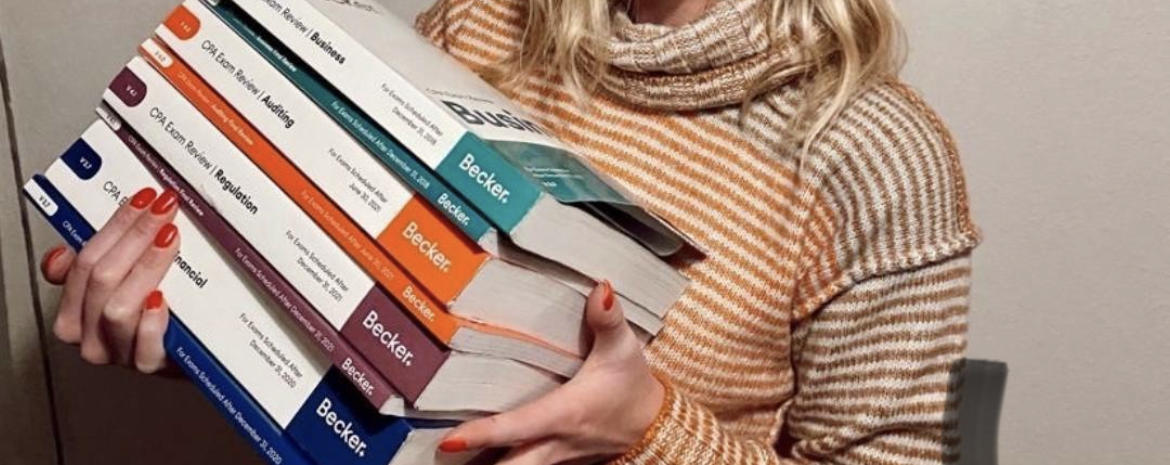

One small thing she did that made a big impact was scheduling her test dates months in advance to hold herself accountable. Anne also saw that all the Big 4 firms used Becker’s CPA Exam Review, so enrolling in the program gave her the structure and support she needed. “I wanted the best course available,” she said.

Be strategically short-sighted

Anne’s two-part approach to becoming a CPA meant that she had to be deliberate and methodical, particularly when it came to studying for the exam.

The hardest part for Anne was sustaining the discipline needed to get through all the study material in a relatively short amount of time. “I had zero interest in some of the topics,” she said frankly, “and add to that the level of granular detail you need to learn and memorize, and the whole thing can be completely overwhelming.”

There are no shortcuts when it comes to mastering the concepts for the CPA Exam. Anne’s best advice when you’re feeling overwhelmed is to “just grind it out.” Focus only on what’s right in front of you and don’t look ahead too much.

Take breaks, especially when you’re overwhelmed

Working full-time while studying for the CPA Exam is like having a second job after doing your first job. You can burn out easily if you don’t give yourself breaks.

Anne’s favorite study buddy, Dexter the cat

Although Anne had to limit hanging out with family and friends to just weekend nights, she destressed often by working out three to five times a week. She also broke up long study sessions with beach walks to reset and reconnect with nature.

Choosing Becker as your study partner

Having Becker’s CPA Exam Review course to lean on let Anne focus on getting through all the material; she didn’t have to worry about putting together a study plan herself. She found comfort in the predictability of Becker’s methodical, structured, yet customizable approach to teaching and learning. “I pretty much followed the suggested path of the program,” she said, which included taking notes on the lectures and practicing with multiple-choice questions and simulations. Being able to create her own “mini exams” was another way Becker gave her the tools to personalize her learning.

Your talent doesn’t fade with age

Life is unpredictable. Your priorities can change, too. While it can feel jarring to be faced with unexpected decisions later in your career, you owe it to yourself to consider the possibilities. As Anne has proven, being older can be an advantage: “I was 61 the day I passed all four parts [of the CPA Exam]. I am pretty sure my maturity and world wisdom contributed to my success.”